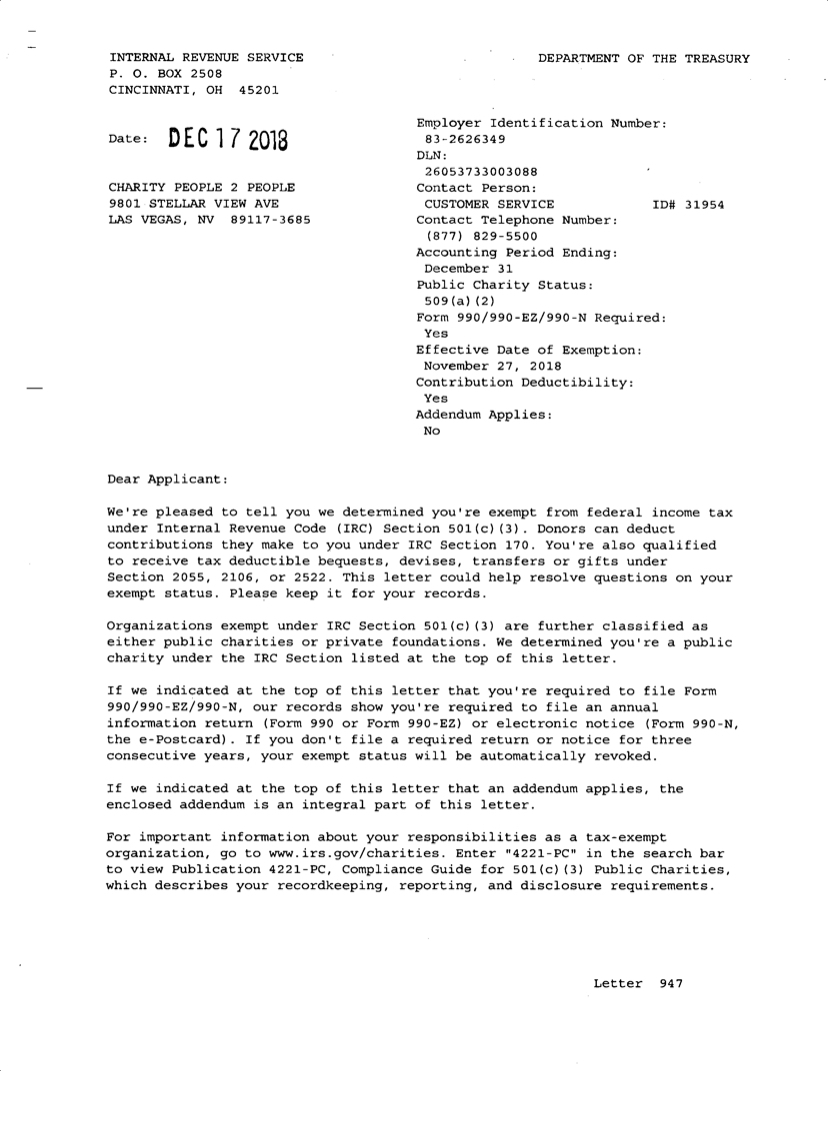

Tax Exempt

Charity People 2 People is Tax Exempt organization. Department of the Treasury lnternal Revenue Service Tax Exempt and Government Entities PDF document is attached.

Dear Applicant: We're pleased to tell you we determined you're exempt from federal income tax under Internal Revenue Code (IRC) Section 501(cX3). Donors can deduct contributions they make to you under IRC Section 170. You're also qualified to receive tax deductible bequests, devises, transfers or gifts under Section 2055,2106, or 2522.This letter could help resolve questions on your exempt status. Please keep it for your records.

Certificate of Formation Nonprofit Organization

Charity People 2 People has a legal nonprofit status. Recognition of Exemption Under Section 501 (c)(3) ofthe lnternal Revenue Code PDF document is attached.

Section 501(c)(3) is the portion of the US Internal Revenue Code that allows for federal tax exemption of nonprofit organizations, specifically those that are considered public charities, private foundations or private operating foundations.

CharityP2P EIN

Charity People 2 People is legally registered in the state of TX. Secretary of state article of incorporation of a Nonprofit Public Benefit Corporation PDF document is attached.

a. This corporation is organized and operated exclusively for the purposes set forth in Article 4 hereof within the meaning of Internal Revenue Code section 501 (c)(3). b. No substantial part of the activities of this corporation shall consist of carrying on propaganda, or otherwise attempting to influence legislation, and this corporation shall not participate or intervene in any political campaign (including the publishing or distribution of statements) on behalf of any candidate for public office. c. The property of this corporation is irrevocably dedicated to the purposes in Article 4 hereof and no part of the net income or assets of this corporation shall ever inure to the benefit of any director, officer or member there of or to the benefit of any private person. d. Upon the dissolution or winding up of this corporation, its assets remaining after payment, or provision for payment, of all debts and liabilities of this corporation shall be distributed to a nonprofit fund, foundation or corporation which is organized and operated exclusively for charitable, educational and/or religious purposes and which has established its tax-exempt status under Internal Revenue Code section 501(c)(3).

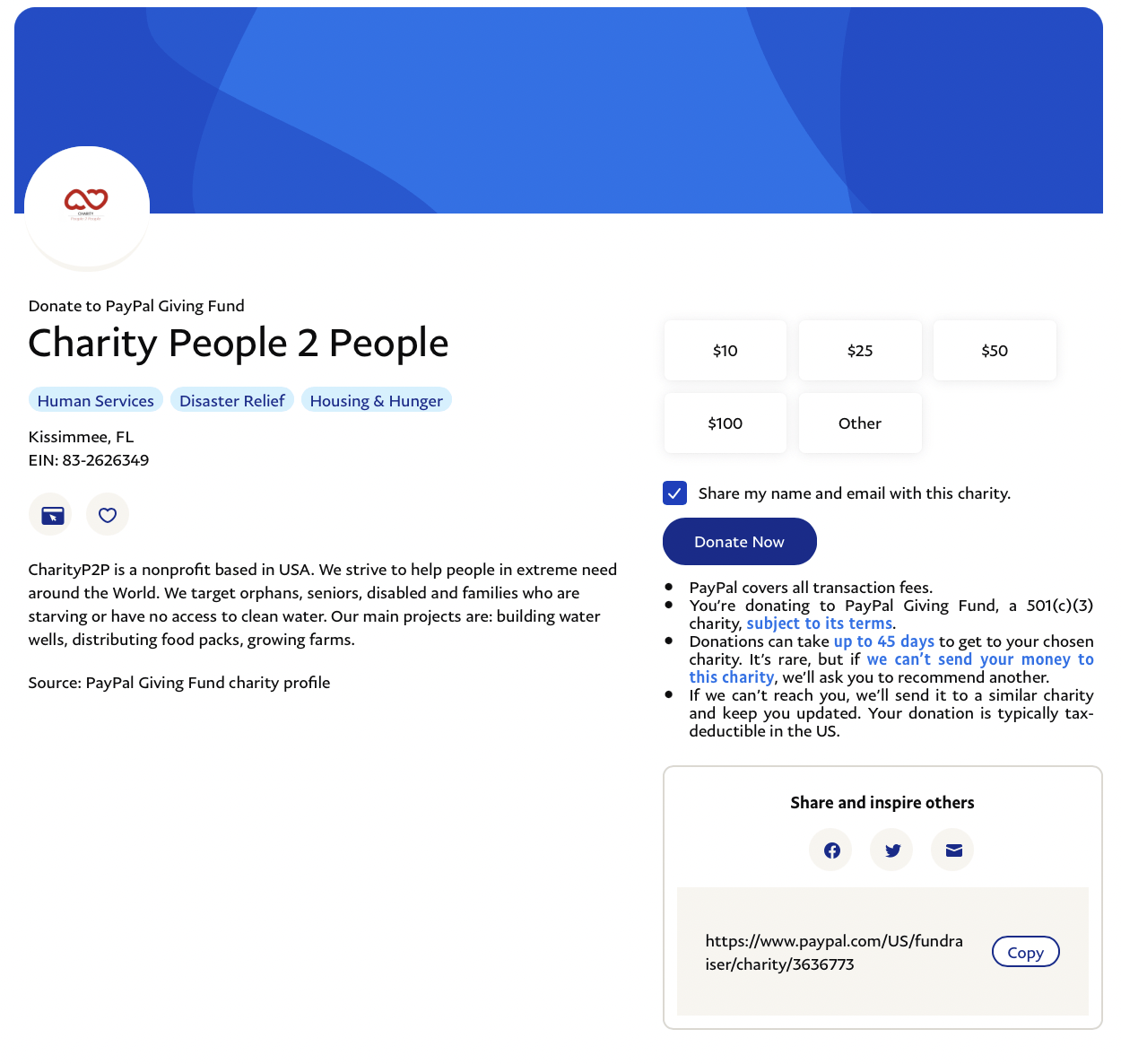

Paypal Giving Fund

Charity People 2 People is registered with PayPal Giving Fund. Only 501c3 nonprofit organizations are qualified to register with this platform to receive donations. There is no fees to send or receive the donated funds.

PayPal Giving Fund helps people support their favorite charities online. We receive donations through PayPal, eBay, and other technology platforms and make grants to our donors' recommended charities. PayPal Giving Fund is an IRS-registered 501(c)(3) public charity (Federal Tax ID: 45-0931286).

Candid GuideStar

Charity People 2 People is registered with GuideStar. Only 501c3 nonprofit organizations are qualified to register with this platform. It is required to be registered with GuideStar to receive donations from FB and Insta fundraisers.

GuideStar is a 501(c)(3) public charity. GuideStar lists information on every nonprofit registered with the IRS as tax exempt, as well as data on former nonprofits. GuideStar obtains the information from the nonprofits themselves, the federal government, and partners in the nonprofit sector.

Form 990N

Charity People 2 People has been filing form 990n with IRS since 2018.

Small tax-exempt organizations generally are eligible to file Form 990-N to satisfy their annual reporting requirement if their annual gross receipts are normally $50,000 or less. Gross receipts are the total amounts the organization received from all sources during its annual accounting period, without subtracting any costs or expenses. Gross receipts are considered to be normally $50,000 or less if the organization: Has been in existence for 1 year or less and received, or donors have pledged to give, $75,000 or less during its first tax year; Has been in existence between 1 and 3 years and averaged $60,000 or less in gross receipts during each of its first two tax years; and Is at least 3 years old and averaged $50,000 or less in gross receipts for the immediately preceding 3 tax years (including the year for which calculations are being made).